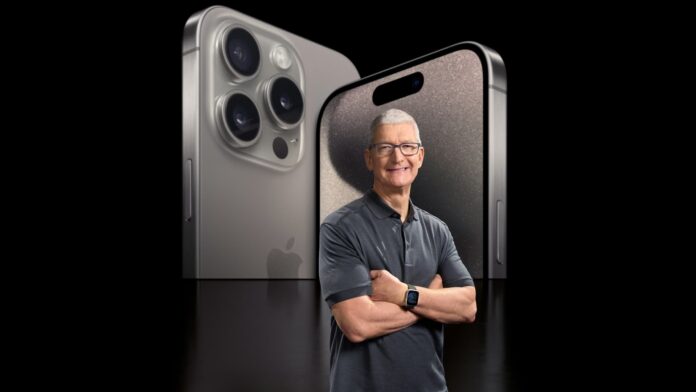

Apple needs to ease investor concerns over its artificial intelligence strategy and renew excitement around the iPhone if it hopes to regain its reputation as a technology leader and innovative disruptor. For years now, the iPhone maker has garnered the love of the retail investing community as shareholders flocked to the technology behemoth once at the forefront of the latest trends. But the tides have shifted in recent months as investors overlook the $2.6 trillion company for rosier AI opportunities. “Everybody’s waiting for Apple to come along,” said Max Wasserman, co-founder and senior portfolio manager at Miramar Capital. “Great cash flow, great balance sheet, but they’re just not demonstrating that they’re going to be the new leader in AI.” AAPL YTD mountain Apple shares year to date These concerns have contributed to the stock’s significant underperformance in 2024, with shares down 12% year to date, and lagging the S & P 500, tech-heavy Nasdaq Composite and “Magnificent Seven” peers such as Nvidia , Meta Platforms , Amazon and Microsoft. This week alone, shares have sunk more than 5% after a $2 billion European Union fine and a report of a 24% year-over-year decline in iPhone sales in China. The fall from grace enabled Microsoft to dethrone the Tim Cook-run business as the most valuable public company. Shares have also lost their luster on Wall Street, with only 60% of analysts retaining a buy or overweight rating on the stock, down from nearly 80% a year ago, according to FactSet. Despite the rough start to 2024, investors haven’t lost all hope on Apple, trusting that the previous market leader can reassert its technology dominance by unveiling a cohesive AI plan and reaccelerating iPhone growth. “This is not a dead story, it’s more of an out-of-favor story,” said CFRA Research’s Angelo Zino. “At some point in time, we do think it comes back into favor, but it is a ‘show me’ story right now on the top line.” Easing growth and dwindling iPhone excitement Despite its dominant position in the global smartphone market, Apple has suffered in recent quarters from stunted growth, stagnant sales, market share losses in China and a lack of excitement over the iPhone. AAPL 1Y mountain Apple’s stock over the last year Last quarter, Apple reported 2% revenue growth after four consecutive quarters of declines, but showed a 13% year-over-year drop in iPhone sales in China as it faces heightened competition from Huawei. Accounting for more than half of sales, the iPhone plays a pivotal role in Apple’s growth, but has fallen victim to many customers holding onto their phones for longer than in previous upgrade cycles, Wasserman said. That’s due in part to the lack of compelling new features luring users to upgrade their phones. He views a phone with new AI capabilities as that potential catalyst that can reverse the course and convince customers to take a bite. Absent signs of significant growth, investors may no longer be willing to support Apple’s superior price-to-earnings multiple of 25 times next year’s earnings, said Paul Meeks, co-chief investment officer at Harvest Portfolio Management. “You can’t be a tech company unless you’re growing your revenue” faster than the S & P 500 and the average company, he said. “That’s what people expect from tech and there’s some real anxiety about the long-term story and saturation in the phone markets.” Apple’s AI story Last month, Apple pulled the plug on its decade-long autonomous vehicle project in what many on Wall Street viewed as a move to divert resources toward AI prospects. But the company has done little to articulate its AI vision. Investors are viewing this as necessary for a technology giant to compete in this AI-driven world. “We still haven’t seen a cohesive strategy that says this is how we’re going to use AI, how we’re going to monetize AI,” said Miramar’s Wasserman. “That’s the key thing. They need to get the consumer to want to spend.” What has also shocked investors such as Wasserman is the company’s inability to deliver on AI despite its long history in innovation. Over the years, the company’s growth has been synonymous with the smartphone, and it has been able to harness a rock-hard balance sheet and cash flows to innovate. In a note to clients this week, Melius Research’s Ben Reitzes called an AI strategy the “most important launch since the iPhone.” The move could drive upside to its services business and convince users to upgrade, while creating a 2025 “Supercycle” akin to ones seen in 2020 and 2021, and 2014 and 2015. Apple’s Worldwide Developers Conference in June also presents an opportunity for the company to roll out these AI plans and regain its position as a “historically disruptive innovator” that’s critical to its premium valuation, said Rosenblatt’s Barton Crockett in a Tuesday note. Another way Apple could satisfy the need for AI progress is through a merger or acquisition of a company with large-scale AI capabilities, Meeks said. AAPL 1M mountain Apple shares over the last month That possibility isn’t out of the question from a financial standpoint but could contradict the company’s long view that products made outside of Apple are “inferior,” he said, noting that the firm hasn’t made a big purchase since it bought Beats for $3 billion in 2014. Despite these hurdles, investors aren’t ready to give up on the stock just yet. Both Wasserman and Meeks have retained positions, but are awaiting more innovation news before considering beefing up their stakes. “They can right the ship because they have the balance sheet, but they’re going to have to do more than just coming out with a regular new iPhone or the goggles,” Wasserman said. “They have the ability, but I think it’s going to take six months to a year.” â CNBC’s Michael Bloom contributed reporting.