Startups and

innovation more broadly are critical across the travel industry, spurring

advancements that often tap into emerging technologies to create better

experiences for travelers or to enhance efficiency and operations for suppliers

and stakeholders.

Each November

PhocusWire publishes its selection of the 25 travel startups poised to stand

out in the coming year. There have been 150 companies recognized through the

Hot 25 dating back to November 2018 and collectively those startups have raised

nearly $2.5 billion dollars.

Funding is but

one measure of the health of the travel startup ecosystem and investor

confidence, but it is a meaningful indicator.

PhocusWire’s sister brand, Phocuswright, tracks this

data in Phocuswright’s Travel Startups

Interactive Database, which includes more than 4,600 companies

that have generated more than 8,500 funding rounds totaling over $200 billion

from almost 8,400 investors since 2005.

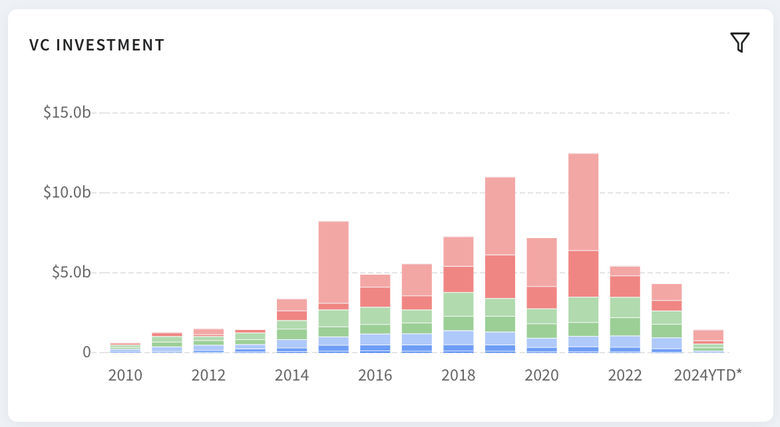

The data shows that travel funding totaled $5.3 billion in 2023, down significantly from $12 billion in 2022, and that 2024 is at about the same pace with $3.1 billion raised through late June.

The slowdown in

travel funding correlates with a broader slowdown in the activity of venture

capital firms. According to a March 2024 Business Insider article containing an

analysis of Pitchbook data, “The number

of active traditional VCs in venture capital deals in the United States peaked

at 18,504 in 2021. … That fell to 15,985 in 2022 and to 9,966 last year.”

And yet, while the current macroeconomic environment is challenging, some travel startups have raised significant rounds already this year, notably TravelPerk’s $104 million Series D-1 extension in January, Mews’ $110 Series D in March and Guesty’s $130 million Series F in April.

The list

To bring more

transparency to travel investors’ activity and strategies, PhocusWire last year began

publishing a list of the top investors in travel technology.

The list is based

on analysis by Phocuswright senior manager of research and innovation, Mike

Coletta.

Similar to last

year, the analysis highlights the investors that are most active or are

contributing the most non-debt funding to the ecosystem. Since the specific

amounts of contributions by each investor in each funding round is generally

not publicly available, the analysis zeroed in on those who invested in at

least three travel companies between May 2023 and May 2024 and/or have a

specific focus on travel and stated plans to invest more.

Based on those

criteria, following is the list of top travel tech investors and a sample of

the companies they have invested in during the specified time period, with

links to our coverage of the startups’ funding as applicable.

“Considering

the recent drastic downturn in funding, and even with signs of softening demand

on the horizon, it’s fantastic to see investors continuing

to bet on travel, from stalwarts like Thayer, JetBlue Ventures and Plug and

Play to newcomers like Antler and Gaingels,” Coletta said.

- Thayer

Ventures/Derive Ventures – 13 investments including Mews, Point.me, Canary,

Directo - Antler – 7

investments including Airalo, Unravel and TravelTail - JetBlue

Ventures – 6 investments including Avnos, NLX and Tomorrow.io - Plug and Play

Tech Center – 6 investments including Neoke, Point.me and Sherpa - TechStars – 4 investments

including NaviSavi, SquadTrip and TripSlip - Gaingels – 4 investments

including Anyplace, Point.me and Summer - FJ Labs – 3 investments:

Dharma, Fairlyne and FlyFlat - SpeedInvest – 3

investments: Fairlyne, Raus and Smiler

Honorable

mentions:

Investor

insights

We also reached

out to the companies on this list to gather insights about their investment

strategies, how they work with their portfolio companies, where they see

opportunities for innovation and their take on the hype around artificial

intelligence. Here are some of those responses, in some cases edited for

brevity.

What are the

key criteria you consider when evaluating an investment opportunity?

Kristi Choi, early

stage investor at Plug and Play Tech Center: While various factors go into our

investment decision-making process, as early-stage investors, strong conviction

in the founder(s) is fundamental. Companies will go through various stages and,

in many cases, product iterations. In the end, we’re looking

for founder(s) who are focused and decisive, have superior execution skills and

know when to make the right turns at the right time. We also ask ourselves if

this is the right person to be solving this exact problem. The answers to these

questions should be an easy yes across the board.

Jeroen Arts,

partner in the marketplaces and consumer investment team at SpeedInvest: We

pride ourselves with being the first institutional backer in most of our

portfolio companies. When you are investing at such an early stage, the most

important criteria we invest in are the people who are building the product and

service. In the seed-phase of a company, 99% of the journey is still ahead of

the company and, as such, we rate the team and their ability to execute as the

most important.

Chris Hemmeter, managing

director at Thayer Ventures: We focus on five things specifically: market

dynamics, unit economics, go-to-market engine, progress and people.

Specifically, we are looking for large addressable markets or smaller segments

that are expanding fast, strong unit economics that promise capital efficiency,

a repeatable go-to-market motion that is consistent with the former

characteristics and revenues typically above $2 million to $5 million. People, however,

is by far the most important. We are looking for special leaders who can

inspire.

Lorenzo Thione,

managing director of Gaingels: We look at the business opportunity to create a

large sustainable company, in a large enough market to drive substantial

returns. This also relies on evaluating the company’s competitive advantages

either rooted in technology, product or team, and its unit economics. Finally,

and probably the most important element we consider is the founding team. Co-investors and valuation come into play too, but they are less central to our

investment decisions.

In the end, we’re looking for founder(s) who are focused and decisive, have superior execution skills and know when to make the right turns at the right time.

Kristi Choi – Plug and Play

Jeff Weinstein,

partner at FJ Labs: Our favorite startup to invest in is one that is showing

early semblances of product market fit, but is not yet at scale. We like our

capital to be used for scaling businesses quickly with working unit economics.

How do you

like to work with your portfolio companies?

Plug and Play/Choi: We

place a lot of trust on the founders that we bet on, and we strive to add value

by leveraging our extensive global network to connect our portfolio companies

with potential customers, partners and industry experts. Plug and Play works

closely with over 600 corporations globally across 20+ industries, and we are

constantly identifying business development opportunities for our portfolio

with the goal of shortening sales cycles. Our job is to be master matchmakers.

For the earlier stage companies, our model can significantly help with

achieving and fine-tuning product market fit.

Gaingels/Thione:

We work much like a traditional minority investor that doesn’t take board

seats. Because we have a large portfolio we tend to be more reactive rather

than proactive, but we can step in to support our companies whenever they need.

Our large portfolio and network of investing members make Gaingels a

particularly valuable and supportive investor for companies seeking

introductions to potential business partners, customers and/or other investors.

We also help our portfolio companies by bringing diverse capital on their cap table

and making room for underrepresented investors, helping them with developing

their boards of director and advisory, by sourcing and recommending candidates

from underrepresented backgrounds and supporting them in their recruiting

efforts by helping them tap into pools of diverse talent they may not have

access to.

Thayer/Hemmeter:

We consider ourselves a strategic investor and like to say that we work with

our companies between board meetings, not just at board meetings. We try to

serve as their business development, sales and strategy partner and focus on

opening doors and driving action. I personally spent the bulk of my career

building businesses and understand that helping entrepreneurs connect with

potential customers is the primary definition of “value

add.”

Where do you

see the biggest opportunity for innovation today in travel?

Plug and Play/Choi: We’re currently having many conversations

about convergence in the travel industry with increasingly integrated vertical

software. There’s been heightened demand from consumers

and agents for a one-stop shop, yet the industry remains fragmented, causing

friction. We’ve been seeing more of this convergence

happening lately, especially on the corporate travel side, with significant

activity in fintech, expense management and travel booking. We’re keeping a close eye on other

sub-sectors to identify similar trends and patterns.

Thayer/Hemmeter:

The accommodations tech stack, vertical software and services, activities and

experiences, related payments solutions, loyalty and consumer are some of the

areas where we are concentrating. We are also very interested in AI but only as it

pertains to the application layer and how it solves interesting problems in the

travel space.

For many AI startups, we worry that they are running on an increasingly accelerating treadmill, consuming massive amounts of capital just to stay in place.

Jeff Weinstein – FJ Labs

SpeedInvest/Arts:

On the consumer side, we see a clear shift toward a highly personalized and

seamless travel booking experience. Rather than providing customers with “information,” we see platforms leveraging AI and data

to offer highly tailored travel itineraries. Additionally, with the rapid buildup of infrastructure and capabilities of AI, there is a clear path to

autonomous travel agents that will eventually take care of the tedious process

of booking your trip.

In a similar

vein, yet less obvious, we see AI also being a big agent for change on the B2B

side. There are a lot of new technologies coming online that will allow us to

run leaner and smarter travel operations. Whether it’s at

airports, in hotels or somewhere along the way of your journey, we believe

there will be a new set of travel startups to start to resolve some of the

current inefficiencies.

How are you

seeing the hype around AI impact the travel startup landscape?

Plug and Play/Choi: There

was a lot of noise to sift through in the earlier months. I think some of that

noise has died down, and we’re now starting to see impactful

applications develop that are hyper-focused on reducing costs and improving

service quality in travel. There is a ton of potential, and the travel startup

landscape will reflect that. However, like in many other industries, there is

currently a significant gap in corporate adoption of generative AI applications, so it’ll take some time.

FJ Labs/Weinstein:

AI is seismically shifting the playing field for startups, so we think a lot

about defensibility (see the excellent strategy book 7 Powers by Hamilton Helmer for a framework

that we think about sustainable value creation). For many AI startups, we

worry that they are running on an increasingly accelerating treadmill,

consuming massive amounts of capital just to stay in place. So we prefer

to focus on narrow applications of AI within existing workflows or software

tools that benefit from AI, rather than AI itself.

Thayer/Hemmeter:

AI for travel startups is a tool, not a solution in and of itself. What’s most interesting is the business

problem being solved — in other words, how the tool is being leveraged in the

application. It’s an important and exciting new toolbox, to be sure, and many startups are figuring out how to solve problems in new

ways. That said, integrating AI into a bad idea doesn’t get very

far. It’s also important to note that unlike

past innovations that caught incumbent players flat-footed, AI has been a

central part of their work for many years, and they have the power to maintain

leadership. It’s unlikely that any startup will “out-AI” the big guys, while that wasn’t true for mobile, for example.

Gaingels/Thione:

While there are a subset of companies that attract headlines, investors and

attention and therefore are able to raise at inflated valuation, the true

economic impact of AI in the long term is unlikely to be hyped. There is an

enormous amount of VC spending that is ahead of the value unlock chain because

it’s funding compute deployment, and some of that capital may be at risk of

being devalued by future improvements on the hardware side, but the true unlock

of value from a productivity and staffing point of view for the small and

medium enterprise, especially in traditional/boring industries is yet to be

seen.

What is your

outlook for startup funding generally across the travel industry for the next

few years?

SpeedInvest/Arts: While travel has picked up considerably since the end of the pandemic, as people are happy to be back exploring the world, VC investment in the travel industry has – somewhat counterintuitively – traveled the opposite direction (see chart below from Dealroom). We see less travel startups being funded (across all stages), and the lower amount of total invested capital in travel startups is getting more concentrated in a smaller group of “winners.” I do believe that this strong bifurcation in the market will ease a bit in the coming 12-24 months; however, fundraising for startups in general, and travel startups specifically, has changed 180 degrees vs. its peak year of 2021.

Plug and Play/Choi: We are

optimistic. There’s still a lot of work to be done and

lots of opportunities to build meaningful technology across the travel

industry.

Thayer/Hemmeter:

I am bullish, but not from a “number of

deals” and “total

dollars deployed” perspective. I am bullish about the quality of startups in

travel and the dislocation and disruption happening across the $10 trillion

value chain. In my view, looking at total number of deals and absolute dollars

deployed says more about venture capital than startups. Too many

shoot-for-the-moon ideas got funded when cash was free, and VCs were eager to

deploy. At the same time, round sized grew too large as VCs looked to fully invest

in order to get back to their LPs with the next Roman numeral fund. The result

was a great deal of noise in the market that, ironically, generated headwinds for

the best companies and too much cash that harmed the teams that took it on. We

are, thankfully, living in different times and are back to quality, efficiency

and grit. That this is happening against a dynamic global industry like travel

is very exciting. I think we will continue to see great companies born during

this period, and disciplined funding will certainly be there to support them.

Gaingels/Thione:

People are back to traveling to equal or higher than pre-pandemic levels. They

are also finding ways to do more with less because of rising inflation, so

wherever technology can help with identifying travel opportunities while

reducing cost, maximizing utilization and inventory management, removing

intermediary inefficiencies that increase costs and renewing a focus on

experiential rather than luxury travel, will be a space ripe for investment and

value creation across the travel value chain.

FJ Labs/Weinstein:

One of my favorite trends right now is investing in startups that dramatically

improve productivity within existing communication workflows. This means that

people can become customers without requiring massive behavior changes.

For example, we invested in FlyFlat, which is a business-class flight booking

service where the entire UI/UX lives within Whatsapp/SMS/your messenger of

choice.

Phocuswright’s Travel Startups Interactive Database

You no longer need an Open Access

subscription to interact with data on thousands of travel startups founded

since 2005. This dynamic database of travel companies includes a wealth of data

on startups, with the ability to filter, sort and drill down on the information

that is most relevant to your business.