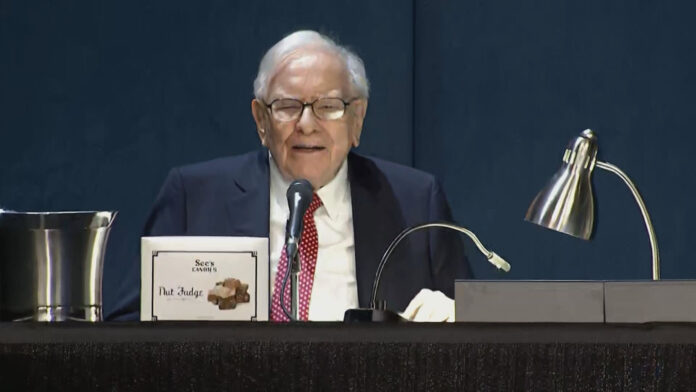

Warren Buffett made headlines at last weekend’s Berkshire Hathaway annual meeting , including remarks explaining why he trimmed his big Apple bet , outlining his succession plan and warning of risks tied to artificial intelligence . But the 93-year-old, Oracle of Omaha’s insightful commentary actually went far beyond these topics at what’s affectionately called the ” Woodstock for Capitalists .” On Berkshire buybacks Berkshire spent $2.6 billion in the first quarter of 2024 to buy back its own common stock on the open market, up from $2.2 billion in the fourth quarter of 2023. Buffett said he feels good about his conglomerate’s pace of buybacks right now, but if prices are attractive, he would spend even more. “Under certain market conditions, we could deploy quite a bit of money in repurchases,” he said at the shareholder meeting. “We will try to reduce shares when it makes sense to do so. And we will hope for an occasional big opportunity. And we’re quite satisfied with the position we’re in. Berkshire paid $9.2 billion in all of 2023 to repurchase both Class A and Class B shares. Companies buy back shares when management views the stock as undervalued, and they can boost reported earnings per share by reducing the number of shares outstanding. Cash to reach $200 billion The company’s cash hoard reached a record $189 billion in the first quarter, up from almost $168 billion in the fourth quarter. The investing guru said the cash pile could even reach a whopping $200 billion by June. “I think it’s a fair assumption that [cash holdings] will probably be about $200 billion at the end of this quarter,” Buffett said. “We’d love to spend it, but we won’t spend it unless we think they’re doing something that has very little risk and can make us a lot of money.” Part of the increase in its cash position came from trimming 13% of Berkshire’s stake in Apple in the first quarter. Cash is attractive Asked about the lack of action to invest his mountain of cash, Buffett revealed that he finds cash attractive right now compared to other assets, especially equities. “I don’t mind at all, under current conditions, building the cash position,” he said. “I think when I look at the alternative of what’s available in the equity markets, and I look at the composition of what’s going on in the world, we find it quite attractive.” Buffett previously said he’s been buying 3- and 6-month Treasury bills yielding more than 5% every Monday at weekly Treasury auctions. Don’t pay attention to volatility On the topic of volatility, the Berkshire CEO once again stressed that it shouldn’t matter to those who view their stock holdings as small pieces of businesses. “I would hope many of you don’t even check the price daily or weekly,” he said. “The people who check the price daily have not made the money that the people who’ve forgotten about it basically have over the years. And that’s sort of the story of Berkshire.” Buffett, who at Columbia University studied under Benjamin Graham , the fabled father of value investing, believes that when there’s emotional selling in the market, it offers an opportunity for investors to hunt for bargains. ‘Things aren’t attractive’ Buffett’s recent big investments in five Japanese trading houses have paid off handsomely, but appealing opportunities like those are few and far between, he said. “If I saw one of those now, I’d do it for Berkshire,” Buffett said, referring to his Japanese bet. “You know, it isn’t like I’ve got a hunger strike or something like that going on. It’s just that they â things aren’t attractive. … here are certain ways that can change, and we’ll see whether they do.” Operating CEOs overwhelmingly talk to Greg Abel Buffett surprised many when he announced that his designated successor Greg Abel will have the final say on all Berkshire’s investing decisions when Buffet is no longer at the helm. The billionaire investor further revealed that Berkshire’s operating managers and CEOs are already in regular communication with Abel, not himself. “Overwhelmingly, the operating executives, they prefer to talk to Greg or to Ajit,” he said, referring to Ajit Jain , the head of Berkshire’s insurance operations. “And that’s understandable because I don’t really do much. And I don’t operate at the same level of efficiency that I would have 30 years ago or 40 years ago.” “I would say that the number of calls I get from managers is essentially awfully close to zero. And Greg is handling those,” he added.